You’d think that because it’s June, legislators would be off duty and traveling home to wave in a parade…

or meet with affluent backers…or whatever else they do over the summer break…

Instead, lawmakers in Albany and Washington, D.C., right before the off-season, slammed the brakes on the crypto business. Let’s take a look at the latest news and its consequences, as well as other noteworthy indications in the New Digital World.

The state of New York Has Enacted a Moratorium on Cryptocurrency Mining.

Anyone who read The New Digital World last spring will remember that one house of the New York legislature (the NY State Assembly) placed a two-year prohibition on Bitcoin (BTC-USD) and Ethereum (ETH-USD) miners… However, it was expected that the bill would not clear all of the necessary hurdles before the session closed on Thursday, June 2.

I’m joking, of course! The mining moratorium was passed by the New York Senate before the bell rang. According to Cointelegraph, “several senators flipped from unsure to in support of the measure, citing they are worried about carbon emissions.” “Any new PoW mining facility in the state could only function if it utilizes 100 percent renewable energy,” according to the measure, providing Governor Kathy Hochul signs it.

The importance of renewable energy cannot be overstated. It’s what drew crypto miners to New York in the first place: inexpensive hydroelectric power from the Niagara River, as well as abandoned industrial premises. Recently, it has attracted crypto miners to Kenya, which has a big oversupply of geothermal power.

Miners may also use surplus renewable energy to keep regulators at bay while remaining connected to the grid. As I previously said, the Bitcoin Mining Council’s Q1 study reveals “a 64.6 percent sustainable power mix.” The mining organization adds, “Based on this data, it is projected that the worldwide bitcoin mining industry’s sustainable energy mix is currently 58.4 percent…making it one of the most sustainable businesses globally.”

“Experts think that New York’s move to prohibit PoW mining will have a domino effect, with other states following suit,” Cointelegraph reports. But, in my opinion, this rule concerning “carbon-based fuel” in particular isn’t the end of the world for cryptocurrency miners. It’s also beneficial to citizens’ environmental concerns as well as the tourist business (which New York is not the only state to rely upon).

Meanwhile, the government in Washington, D.C. acts slowly: In March, the White House issued an executive order on cryptography… and now, three months later, we’re starting to see some results.

According to a Bloomberg story, the Biden administration — especially, the Office of Science and Technology Policy – is closing up its study and will disclose it in August. “The research will look at arguments that bitcoin is a social advantage or that it is a local annoyance and a climate nightmare.”

While it’s too soon to predict how the study will finish, whether or not its recommendations will become legislation, or how fast that will happen…

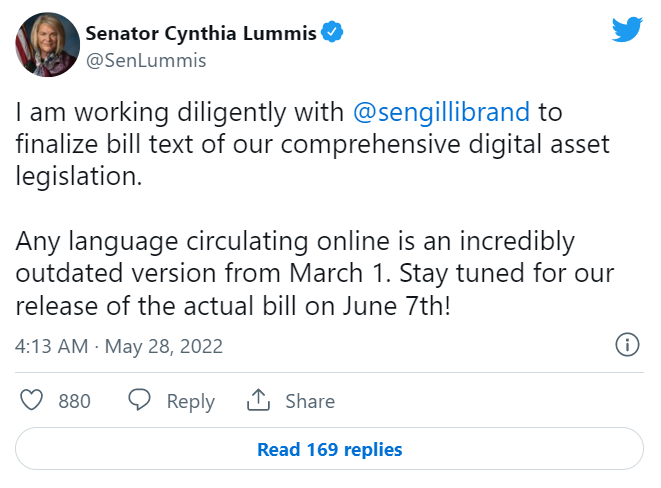

Other sorts of crypto regulation will be announced by the US Senate tomorrow. Senators Cynthia Lummis (R-Arizona) and Kirsten Gillibrand (D-New York) plan to introduce their crypto-oversight measure at that time:

When Gillibrand and Lummis first came together on this measure, this is what we heard: It will be a “broad-based regulatory framework for how this business may be controlled in the future.” According to Gillibrand, parts of this regulation will be handled by the Securities and Exchange Commission, while others will be handled by the Commodity Futures Trading Commission.

It’ll be fascinating to watch how this or subsequent laws deal with stablecoins specifically. The Bank of England, for one, is focusing on the problem, stating that it would “rescue falling stablecoin issuers — if they’re large enough,” as Decrypt put it. According to Blockworks, Japan has enacted a stablecoin regulation, which states that “stablecoins may only be issued by established financial organizations such as registered banks, money transfer agencies, and trust businesses.”

Is There a Crisis in the Crypto Industry?

Coinbase (NASDAQ:COIN) just received – or, depending on your point of view, delivered – yet another kick in the pants. Coinbase and other similar trading platforms are not only suffering in this “crypto winter,” but they are also canceling employment offers!

My crypto Twitter feed is full with sad tales and sympathy for folks who believed they were going to work for Coinbase only to discover they didn’t. According to Blind, an anonymous worker feedback site, the execution was similarly chaotic:

Coinbase had promised prospective workers just two weeks previously that it “would not be rescinding,” just halting fresh hiring. Then it really happened!

To be sure, hiring slowdowns and layoffs are becoming more common in general. However, you’ll notice that there is now a “brain drain” from other businesses to crypto! Particularly sectors that are being impacted by it, such as conventional finance. The issue now is whether this can continue in a bad market.

Well, you’ll need money to recruit personnel. And in the startup industry, venture money is often used. Crunchbase says that, in addition to tech layoffs, VC financing had a bad month in general.

In May, a total of $39 billion was raised. That’s a big number, but it was “the first time in almost a year that it fell below $40 billion.” The May amount is also much lower than the $70 billion high in venture capital fundraising in November 2021.”

I haven’t seen any significant financing announcements in crypto since mid-May. However, it’s worth mentioning that the venture capitalists may be preparing for another wave of major deals: For example, Binance Labs has created a new $500 million fund to invest in Web3… And Andreessen Horowitz (also known as a16z) is putting $4.5 billion away!

What about cryptocurrency pricing and charts? How beneficial are they? So, here’s one sign to keep an eye on:

Bitcoin futures provide a positive outlook for the cryptocurrency’s price.

Even Cathie Wood’s ARK Invest, a bitcoin enthusiast, isn’t fully gung-ho, uber-bullish in their latest Bitcoin Monthly Report for May.

The fact that “the world economy is exhibiting indications of a recession” doesn’t make ARK experts any happier than the rest of us, but they did say that “Bitcoin’s overall network activity remains solid…

In May, centralized exchanges saw record bitcoin inflows, and Bitcoin’s supply remained unchanged for the first time in over a year, reaching an all-time high of 65.7 percent.

I was especially interested in ARK’s findings on market sentiment since they used an indicator that is routinely reported for equities but rarely discussed in Crypto-Land:

When you compare bitcoin futures to the current “spot” price, you’ll see that futures have been trading at a large discount to BTC over the last month or two. You may purchase and trade “perpetual futures” in cryptocurrency exchanges, which is what we see in this chart:

This gap tends to be a positive prediction for BTC prices, as you can see on this chart. When the perpetual futures (orange line) drops below the current price (blue line) and remains there, it usually signals the start of a great bitcoin run. At least, that’s what we saw in the autumn of 2020…and again this summer.

The perpetual-futures discount, according to ARK, “indicates a probable upward trajectory in BTC’s next significant price movement” because “underlying demand surpasses speculative demand.” It seems to be a healthy diet!

BTC Futures Open Interest hit an all-time high in May, according to ARK analysts. Now, this is only true when the prices are denominated in bitcoin; it is not true when the prices are priced in US dollars (given BTC’s recent decline). But, hey, $14 billion in open interest is approximately what we saw last summer during the NFT mania, so it’s not terrible!

Bitcoin remains a crucial gauge for the crypto sector, therefore it’s encouraging to hear some encouraging rumblings under the surface.

Final Thoughts

“Stocks produced a mini-breakout with some positive follow-through action this past week, while cryptos staged a mini-breakout followed by an equally significant drop to pre-breakout levels,” our analysts said in their Crypto Investor Network post on Saturday.

“We expect Bitcoin to fall much lower to $20,000, causing further agony in altcoins.” The Crypto Investor Network believes that “macroeconomic stabilization combined with bullish mood ahead of the fourth Bitcoin halving will likely generate a bottom in the markets” in late 2022 or early 2023.

On the plus side, this may be a positive thing for experienced, discerning crypto investors. “In 2021, the crypto markets were much too frothy and hot. Hundreds of worthless cryptos and blockchain projects entered the market… That froth had to go somewhere, and it did. In their email to members, Luke Lango and his colleagues also say, “This is healthy.”